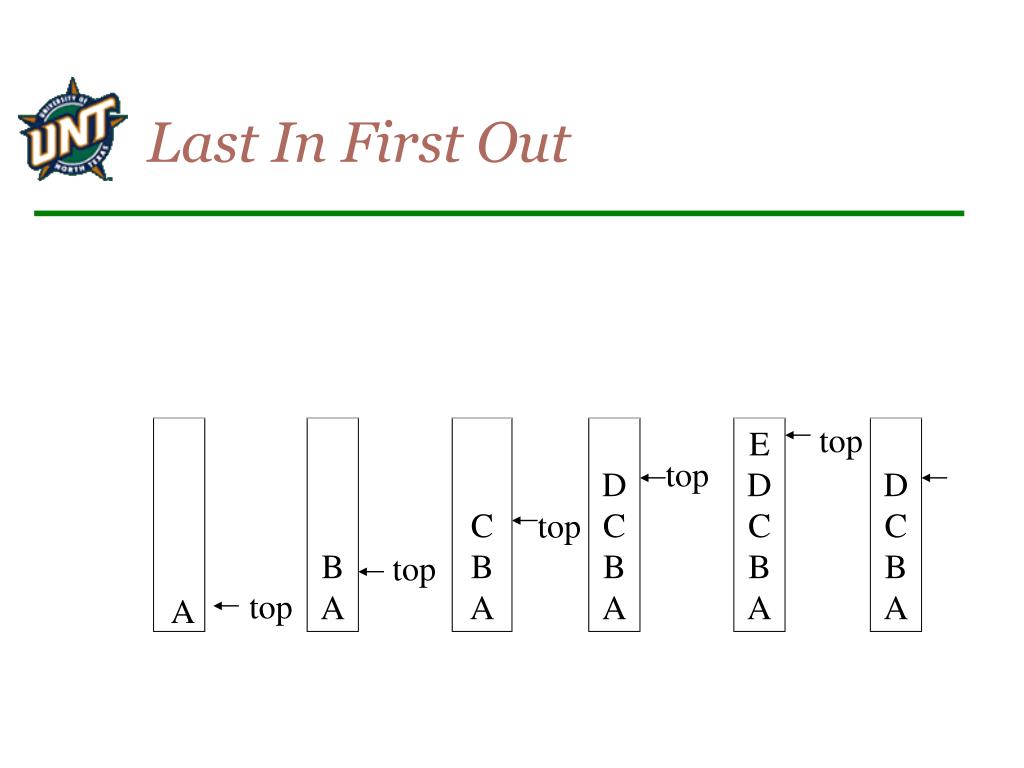

Last In, First Out LIFO

The cost of the remaining 20 is calculated based on the former cost, $30, so they cost you $600. This makes it easy for business owners to manage their accounting and makes it simple for investors to interpret the financial statements. FIFO is an accepted method under International Financial Reporting Standards. This means that ‘first in’ inventory has a lower cost value than ‘last in’ inventory. Even if a company produces only one product, that product will have different cost values depending upon when they produce it.

LIFO Lowers Tax Bills During Inflation

Using FIFO does not necessarily mean that all the oldest inventory has been sold first—rather, it’s used as an assumption for calculation purposes. Learn more about what FIFO is and how it’s used to decide which inventory valuation methods are the right fit for your business. Higher inflation rates will increase xero vs sage the difference between the FIFO and LIFO methods since prices will change more rapidly. If inflation is high, products purchased in July may be significantly cheaper than products purchased in September. Under FIFO, we assume all of the July products are sold first, leaving a high-value remaining inventory.

Business

- LIFO is often used by gas and oil companies, retailers and car dealerships.

- Under LIFO, Company A sells the $240 vacuums first, followed by the $220 vacuums then the $200 vacuums.

- In the retail sector, LIFO is a common method for valuing inventory, especially during periods of inflation.

- Companies that undergo long periods of inactivity or accumulation of inventory will find themselves needing to pull historical records to determine the cost of goods sold.

- The last in, first out (LIFO) method is suited to particular businesses in particular times.

FreshBooks accounting software offers a helpful way to manage business inventory, track new orders, and organize expenses. Generate spreadsheets, automate calculations, and pay vendors all from one comprehensive system. Try FreshBooks free to start streamlining your LIFO inventory management and grow your small business. Based on the LIFO method, the last inventory in is the first inventory sold.

Current COGS Financial Information

Thus, goods purchased earlier were normally bought at a lower cost than goods purchased later. FIFO and LIFO also have different impacts on inventory value and financial statements. Under FIFO, older (and therefore usually cheaper) goods are sold first, leading to a lower average cost of goods sold. Under LIFO, a business records its newest products and inventory as the first items sold. The opposite method is FIFO, where the oldest inventory is recorded as the first sold. While the business may not be literally selling the newest or oldest inventory, it uses this assumption for cost accounting purposes.

This is a common problem with the LIFO method once a business starts using it, in that the older inventory never gets onto shelves and sold. Depending on the business, the older products may eventually become outdated or obsolete. FIFO is more common, however, because it’s an internationally-approved accounting methos and businesses generally want to sell oldest inventory first before bringing in new stock. In most cases, LIFO will result in lower closing inventory and a larger COGS.

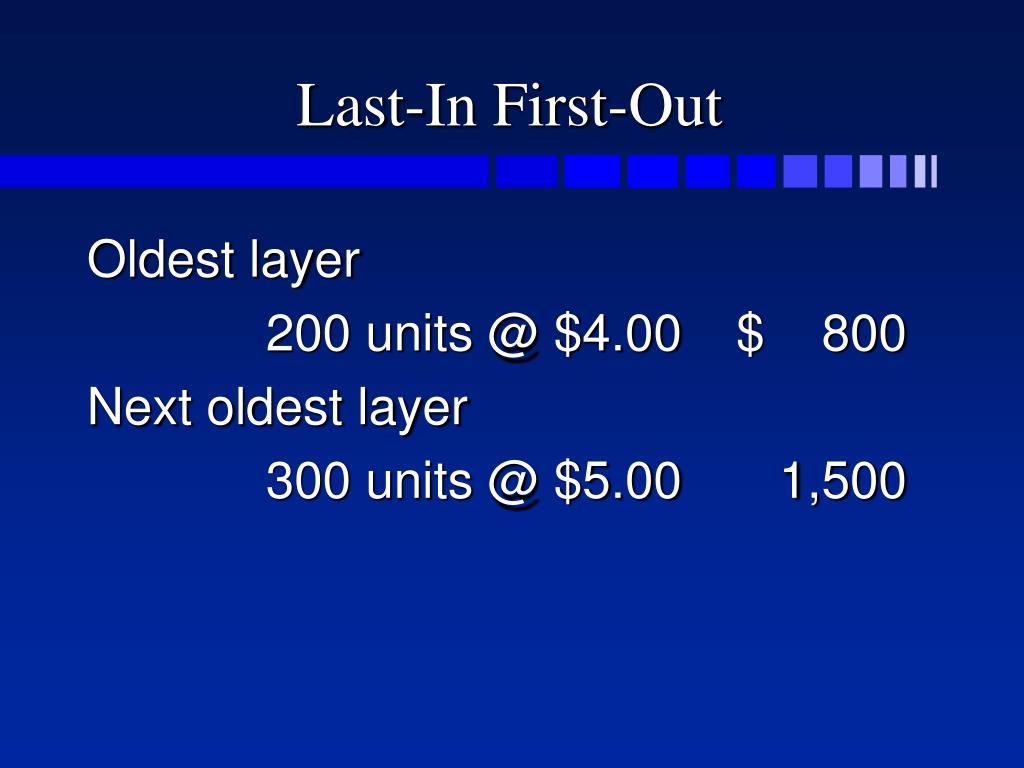

When inventory is acquired and when it’s sold have different impacts on inventory value. Cost of Goods Sold, or COGS, is the amount of money a business pays to produce the number of goods sold in a given period. The products that are left in the warehouse are called remaining inventory. To calculate the cost of sales, we need to deduct the value of ending inventory calculated above from the total amount of purchases.

Our editorial team independently evaluates products based on thousands of hours of research. Finally, FIFO encourages a regular inventory turnover as older stock is sold off first. However, if inventory remains stagnant for a few years, there can be a significant discrepancy between cost of goods sold and market value when sales resume. LIFO, or Last In, First Out, assumes that a business sells its newest inventory first. This is the opposite of the FIFO method and can result in old inventory staying in a warehouse indefinitely. FIFO, or First In, First Out, assumes that a company sells the oldest inventory first.

This translates to a lower gross income and therefore a lower tax liability. Should the cost increases last for some time, these savings could be significant for a business. For example, if you sold 15 units, you would multiply that amount by the cost of your oldest inventory. However, if you only had 10 units of your oldest inventory in stock, you would multiply 10 units sold by the oldest inventory price, and the remaining 5 units by the price of the next oldest inventory. Using the FIFO inventory method, this would give you your Cost of Goods Sold for those 15 units.

Some companies still use LIFO within the United States for inventory management but translate it to FIFO for tax reporting. Only a few large companies within the United States can still use LIFO for tax reporting. Ng offered another example, revisiting the Candle Corporation and its batch-purchase numbers and prices. For example, a grocery store purchases milk regularly to stock its shelves.

Under LIFO, you’ll leave your old inventory costs on your balance sheet and expense the latest inventory costs in the cost of goods sold (COGS) calculation first. While the LIFO method may lower profits for your business, it can also minimize your taxable income. As long as your inventory costs increase over time, you can enjoy substantial tax savings. Keeping track of all incoming and outgoing inventory costs is key to accurate inventory valuation. Try FreshBooks for free to boost your efficiency and improve your inventory management today.

Under the LIFO method, the value of ending inventory is based on the cost of the earliest purchases incurred by a business. As a result, LIFO isn’t practical for many companies that sell perishable goods and doesn’t accurately reflect the logical production process of using the oldest inventory first. With LIFO, when a new item arrives on the shelf it will replace the oldest item of that type and be sold or used first.

Leave a Comment