Inventory Management Methods: FIFO vs LIFO

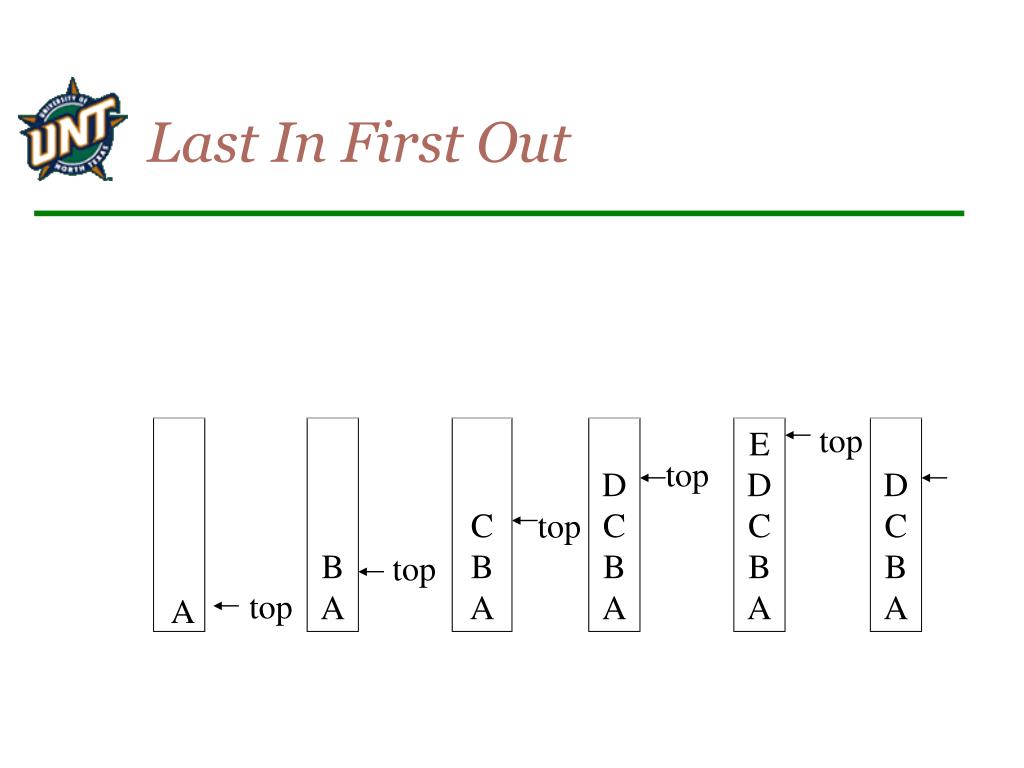

These may be companies like fashion retailers or booksellers whose customers are interested in new trends, meaning that the business must regularly buy and sell new goods. Many countries, such as Canada, India and Russia are required to follow the rules set down by the IFRS (International Financial Reporting Standards) Foundation. LIFO, or Last In, First Out, is an accounting system that assigns value to a business’s inventory. It assumes that newer goods are sold first and older goods are sold afterward. In January, Kelly’s Flower Shop purchases 100 exotic flowering plants for $25 each and 50 rose bushes for $15 each. Once March rolls around, it purchases 25 more flowering plants for $30 each and 125 more rose bushes for $20 each.

Part 2: Your Current Nest Egg

This is because, with a high turnover rate, a FIFO-based cost of goods will approximate a LIFO-based or current-cost cost of goods sold. Although firms can often plan for LIFO liquidation, events sometimes happen that are beyond the control of management. As noted already, at least a portion of the inventories valued under LIFO is priced at the firm’s early purchase prices; this might go back to the date when LIFO was adopted. For example, in 2018, a number of sugar companies changed to LIFO as sugar prices rose at a rapid pace. Cassie is a former deputy editor who collaborated with teams around the world while living in the beautiful hills of Kentucky.

Example of LIFO

Companies have their choice between several different accounting inventory methods, though there are restrictions regarding IFRS. A company’s taxable income, net income, and balance sheet balances will all vary based on the inventory method selected. FIFO and LIFO are two common methods businesses use to assign value to their inventory. They’re important for calculating the cost of goods sold, the value of remaining inventory, and how those impact gross income, profits, and tax liability. The last in, first out inventory method uses current prices to calculate the cost of goods sold instead of what you paid for the inventory already in stock. If the price of goods has increased since the initial purchase, the cost of goods sold will be higher, thus reducing profits and tax liability.

LIFO and FIFO: Taxes

This not only helps in maintaining lower taxable income but also ensures that financial statements portray a true representation of the cost of goods sold (COGS) and gross profit. One of the main reasons businesses opt for LIFO is to match current costs with current torrance ca accounting firm revenues. By assuming that the most recent inventory purchases are the first to be sold, LIFO reflects the current market prices more accurately. This can be particularly beneficial during periods of inflation when inventory costs tend to rise over time.

Advantages of LIFO

Your small business may use the simplified method if the business had average annual gross receipts of $5 million or less for the previous three tax years. For spools of craft wire, you can reasonably use either LIFO or FIFO valuation. For perishable goods — like groceries — or other items that lose their value with time, using LIFO valuation doesn’t make sense because you will always try to sell older inventory first. Business News Daily provides resources, advice and product reviews to drive business growth.

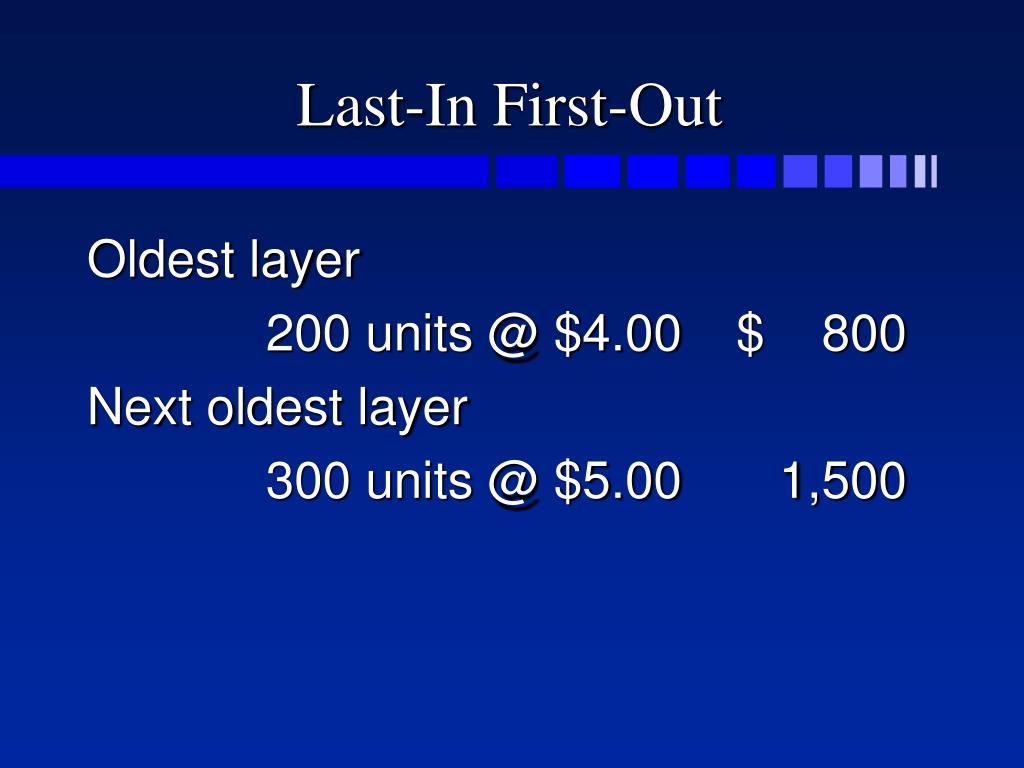

The 220 lamps Lee has not yet sold would still be considered inventory, and their value would be based on the prices not yet used in the calculation. In normal times of rising prices, LIFO will produce a larger cost of goods sold and a lower closing inventory. Under FIFO, the COGS will be lower and the closing inventory will be higher. Correctly valuing inventory is important for business tax purposes because it’s the basis of cost of goods sold (COGS). Making sure that COGS includes all inventory costs means you are maximizing your deductions and minimizing your business tax bill.

- That means that higher costs will yield lower profits, and, therefore, lower taxable income.

- As a result, firms that are subject to GAAP must ensure that all write-downs are absolutely necessary because they can have permanent consequences.

- No, the LIFO inventory method is not permitted under International Financial Reporting Standards (IFRS).

- In this lesson, I explain the easiest way to calculate inventory value using the LIFO Method based on both periodic and perpetual systems.

- LIFO is banned by International Financial Reporting Standards (IFRS), a set of common rules for accountants who work across international borders.

It is up to the company to decide, though there are parameters based on the accounting method the company uses. In addition, companies often try to match the physical movement of inventory to the inventory method they use. LIFO stands for Last-In, First-Out, it is an inventory valuation method where the most recently acquired items are sold or used first. This approach can impact financial statements and tax liabilities by reflecting current costs more accurately during periods of inflation. It’s only permitted in the United States and assumes that the most recent items placed into your inventory are the first items sold.

The LIFO method, which applies valuation to a firm’s inventory, involves charging the materials used in a job or process at the price of the last units purchased. The higher COGS under LIFO decreases net profits and thus creates a lower tax bill for One Cup. This is why LIFO is controversial; opponents argue that during times of inflation, LIFO grants an unfair tax holiday for companies. In response, proponents claim that any tax savings experienced by the firm are reinvested and are of no real consequence to the economy. Furthermore, proponents argue that a firm’s tax bill when operating under FIFO is unfair (as a result of inflation).

It may also impact inventory valuation and tax liabilities, depending on inventory levels and price fluctuations. In the realm of inventory management and financial accounting, businesses encounter various methods for valuing their inventory. Among these methods, the Last In First Out (LIFO) method stands as a pivotal tool utilized by enterprises to ascertain the cost of goods sold (COGS) and ultimately determine their financial standing. This article delves into the intricacies of LIFO, elucidating its significance, application, and implications within the contemporary business landscape.

Start your free trial with Shopify today—then use these resources to guide you through every step of the process. Once you understand what FIFO is and what it means for your business, it’s crucial to learn how it works. Ng offered an example of FIFO using real numbers to show the formula in action.

Leave a Comment